New Federal Tax Credit Program – Non-Business Energy Property Tax Credits

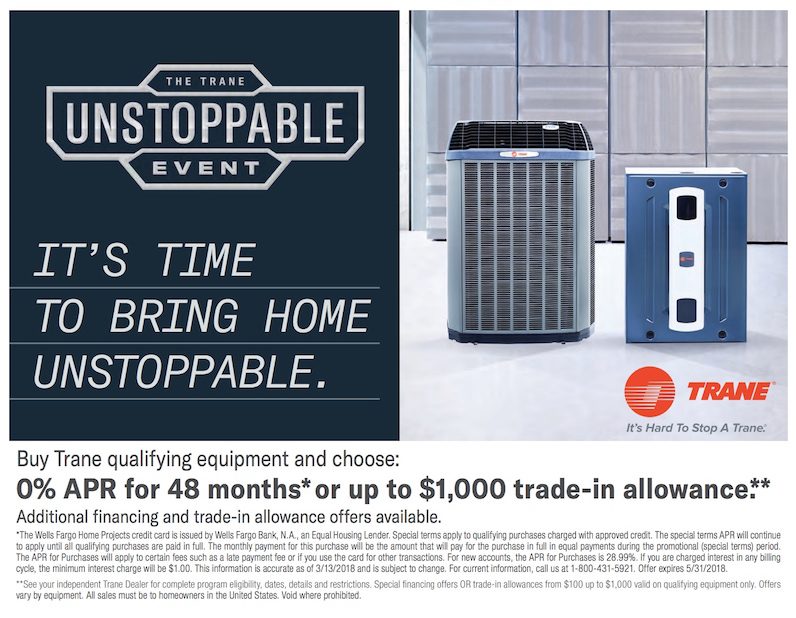

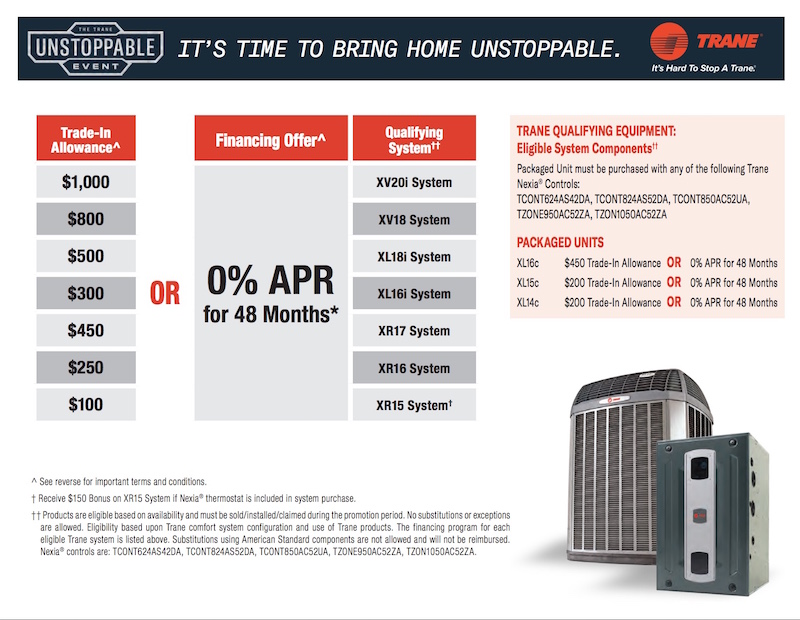

Quinnair Heating & Air Conditioning is excited to announce, the IRS has unveiled the new 2020 tax credits for select high efficiency, energy star rated appliances; such as water heaters, boilers, furnaces, heat pumps & central air conditioning equipment. Although they just brought out this new tax credit plan in January of 2020, the offer is retroactive to cover qualifying installations & home improvements completed between December 31st, 2017 through December 31st, 2020.

Besides installing Energy Star Rated Mechanical appliances, there are other energy savings home improvements that are also eligible for the federal tax credit; like, adding to the insulation in your home, replacing or installing new qualifying windows, doors & skylights, or installing stoves that burn bio-mass fuels to heat your home or water. There are also incentives for replacing your roof with either energy star certified metal or asphalt roofs with pigmented coatings or cooling granules designed to reduce heat gain.

How to qualify for tax credit

High efficiency appliances such as boilers will reduce your energy bill and could be selected for IRS 2020 tax credit.

To qualify for the Tax credit, the equipment / materials must be energy star certified, meeting the required energy factors, must be installed in an existing residential property, the home must be your principal residence & the installation must be completed during the active time frame of the incentive program. Business / commercial properties, new construction & rental properties are Not eligible.

The actual amount of each tax credit varies between the categories, while some credits are a flat amount, other credits are based on a percentage with a maximum savings, or ‘cap amount’. And, if you’re planning on multiple home projects or even a whole home make-over, there is no limit to how many tax credits you can claim, as long as the equipment or materials being installed meet the requirements.

Tax credit benefits

With the introduction of this new tax credit, in conjunction with the EPA’s new rules regarding Air Conditioning systems containing the old R22 type of refrigerant, (which also took effect in January of 2020) it’s a perfect time to upgrade and save some money! Keep in mind, if your electric utilities are supplied by Xcel Energy, all the mechanical equipment that qualifies for the Federal Tax Credit are also eligible for Xcel Rebates, for even greater savings.

If you have any questions about the Tax Credits, Xcel Rebates, or qualifying Equipment, please call the staff at Quinnair or go to the Energy Star link below.